Table of Content

The idea of “fair share” is now arguably more controversial than ever earlier than. In the united states, tax charges for households and firms have fluctuated significantly over the past several decades. Even though inventory market values have continued to increase over many high-tax-rate intervals, that alone isn’t sufficient to conclude that higher taxes are innocuous. Unfortunately, I imagine the united states tax code has turn out to be much more Byzantine in latest years. Unless you’re a CPA or different accounting specialist, good luck figuring it out. Higher tax rates, when paired with layers of deductions or credit score alternatives, could end up being better than decrease tax charges without such flexibility.

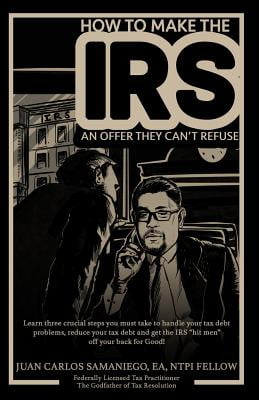

It’s greatest to call several tax aid companies and communicate to a representative to learn extra about whether you qualify for back tax debt reduction. The IRS Fresh Start program allows taxpayers to repay their tax debts via month-to-month funds over six years. Taxpayers can apply for tax relief from the IRS instantly or hire a tax relief company to assist negotiate on their behalf. If you owe a tax debt of more than $10,000, it’s good to hire a tax aid professional who has expertise negotiating with the IRS. An Offer in Compromise lets taxpayers completely settle their tax debt for lower than the amount they owe.

Paying Off Vacation Credit Card Debt

If you change your mind after your initial consultation, you can benefit from its money-back guarantee inside 24 hours. The ConsumerAffairs research staff then thought-about a quantity of elements, together with cost, pricing structure, tax debt minimums and maximums, availability, tax resolution choices, accreditations and customer reviews. The firms under are extremely beneficial by existing prospects and meet our standards for availability and buyer expertise. Read 508 Reviews Represents people, businesses and nonprofits with state and federal tax issues in all 50 states. Our analysis staff vetted 21 tax reduction companies that are rated by more than 2,481 customers.

If it’s been greater than ten years since you’ve been assessed, you might qualify to be relieved of the debt partially or totally. Even if it hasn’t been ten years, you may have the ability to use statute of limitation legal guidelines to your benefit. These kinds of program help shield you from underhanded tax dealings on the a half of your spouse or ex-spouse.

Can The Irs Take All The Money In Your Financial Institution Account?

You ought to evaluate every Provider’s phrases and circumstances to determine which card works for you and your personal financial situation. Information is provided by the Credit Card Providers and isn't a assure of approval. Referrals to companies that assist consumers with tax decision, tax preparation, tax audit assist and other tax issues. Solvable is compensated by some of the firms seen on our web site.

It’s principally a get out of jail free card for first-time offenders. If they owe for multiple years, you'll have the ability to submit a written narrative explaining why the taxes weren’t paid on time, and so forth. If the IRS determines that you've affordable trigger, the penalties could possibly be abated.

The fourth option is submitting for bankruptcy, by way of which earnings taxes could be discharged or written off. Other tax sorts could not qualify; it will rely on your specific case. The key factor to know is, for an income tax to be eligible for a discharge in bankruptcy, you must wait out certain time frames to file. You have to wait 3 years from the tax return due date or wait 2 years from when the tax return was filed.

This includes profiting from certain tax credits and deductions available to you. Your adjusted gross income determines which tax credit and extra deductions you qualify for that may additional cut back your tax invoice. For instance, a married couple with one youngster and an adjusted gross income of $46,884 or much less might qualify for the earned revenue tax credit. If you file a tax return too late and your taxable income drops, Service Australia won't rely the payment.

While pricing isn’t transparent, the company does offer cost plans to help customers with the expense. This full-service company is a good possibility for many who want to get out of tax debt and take it a step additional by creating good tax-preparation habits after the debt is resolved. While working with a tax reduction firm is much less efficient if you have lower than $10,000 in tax debt, Community Tax does accept tax cases of $5,000 or much less. Its website additionally has free assets related to taxes and the IRS that you can use as a beginning place to teach yourself. While Fortress Tax Relief offers free consultations to discuss tax relief options for each particular case, costs depend upon the type of case you're dealing with.

Think of deferring your taxes as getting a government loan — free of charge. You can defer your taxes by investing in an individual retirement account or another tax-deferred retirement account like a 401 and postponing your bonus out of your employer. Here’s a quick take a glance at what you’ll discover on this guide to minimizing tax debt. Requesting a proposal in compromise, a proposal to pay the IRS lower than the total amount due. Your leftover income after paying needed residing expenses is how a lot the IRS will count on you to pay each month. You can full IRSForm 433-AorForm 433-Fto make these calculations, but the IRS may not enable all your expenses.

In truth, the IRS rejected 67% of all purposes for provides in compromise in 2019. In basic, the Internal Revenue Service has 10 years to collect unpaid tax debt. After that, the debt is wiped clean from its books and the IRS writes it off. For 2022, the deduction is phased out when modified adjusted gross revenue is between $70,000 and $85,000 for people and $145,000 and $175,000 for married couples filing jointly. These tax credit embody solar panel set up and solar-powered water heater installation.

Asking for a deferment so that you don't have to make payments till your monetary scenario improves. Ebony Howard is an authorized public accountant and a QuickBooks ProAdvisor tax professional. She has been in the accounting, audit, and tax profession for more than thirteen years, working with individuals and quite so much of firms in the health care, banking, and accounting industries. Creating a plan for the timing of your income and spending is a important a part of the tax reduce.

The Separation of Liability Relief program applies if you’re legally separated or divorced out of your partner. This program helps be positive that your ex (or soon-to-be-ex) spouse’s tax burdens remain his or her personal. Everyone experiences sudden events in life that may lead to big tax payments. Or maybe your gig economic system job brought you more income than you anticipated. At Solvable, we care about your monetary well-being and are right here to help.

A qualified tax debt legal professional can clarify how to qualify in particular element. However, if you are eligible for this program, you could minimize your tax invoice considerably. This means you agree your debt for less with the stipulation that the IRS gets the agreed upon money suddenly.

No comments:

Post a Comment